SAVE Plan Student Loans: A Transformative Step by the Biden-Harris Administration

Introduction

The Biden-Harris Administration’s recent rollout of the SAVE Plan Student Loans initiative marks a pivotal shift for individuals grappling with student loan debt, especially those eyeing homeownership and mortgages. This move is not just about debt relief; it’s a strategic step towards financial empowerment and a more secure future for millions.

What is the SAVE Plan?

The SAVE Plan, standing for Student loan Affordability, Value, and Efficiency, is a revolutionary initiative under the Biden-Harris Administration Student Loan Plan. Tailored to ease the burden of student debt, this plan is a beacon of hope for borrowers nationwide.

Key Features of the SAVE Plan

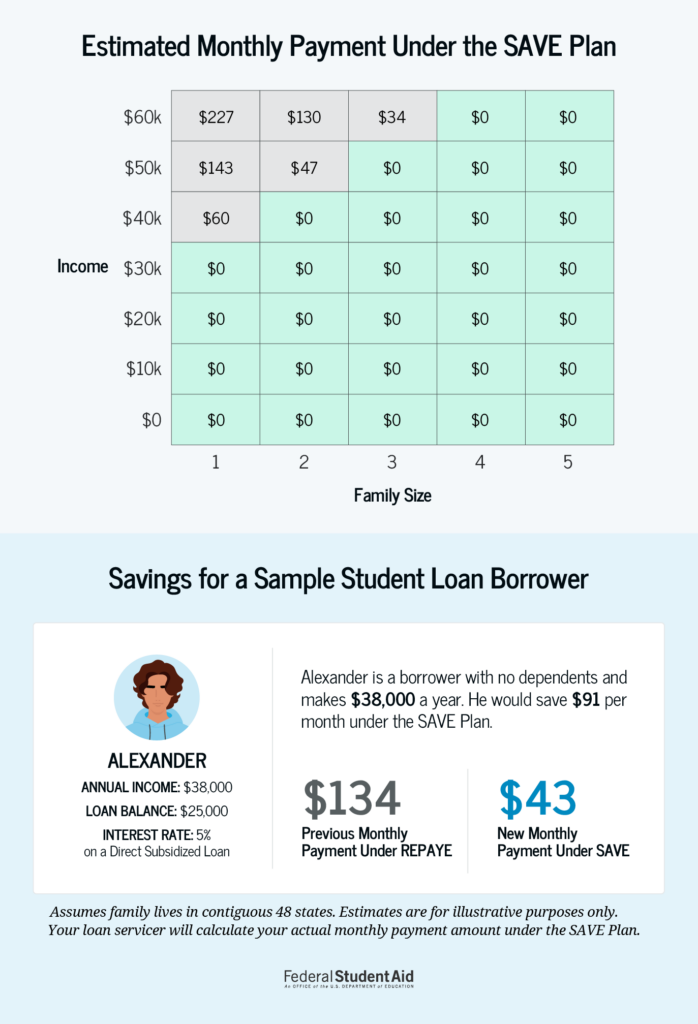

- Reduced Payments for Undergraduate Loans: Aligning with the Biden-Harris Administration Student Loan Plan, this feature halves the payments on undergraduate loans from 10% to 5% of discretionary income.

- Zero Monthly Payments for Many: Under the SAVE plan, borrowers earning below certain thresholds could see their monthly payments drop to $0, significantly aiding in Planning for Homeownership.

- No Growth in Loan Balance: This feature ensures that unpaid interest does not accumulate, preventing an increase in the loan balance and aiding in better Financial Planning for Homeownership.

- Early Forgiveness for Low-Balance Borrowers: Targets those with smaller loan amounts for early loan forgiveness, fostering financial freedom sooner.

Benefits for Mortgage Clients

By being open to eliminating or reducing monthly student loan payments, the SAVE plan enhances mortgage eligibility, offering a more attractive Debt-to-Income Ratio for Mortgages for aspiring homeowners. This key feature of the SAVE Plan Student Loans initiative provides a clear pathway to owning a home, which was once clouded by student debt.

Let’s talk about meeting you where you’re at with your homeownership goals. Book a free consultation today with one of our specialists at the Sincere Mortgage Group at NEXA Mortgage.

Long-Term Financial Planning

The SAVE plan offers a structured approach to loan repayment, directly impacting Financial Planning for Homeownership. It provides predictability and stability, crucial elements for anyone considering a long-term financial commitment like a mortgage.

Pros and Cons

Pros:

- Reduced Monthly Payments: Significant relief for borrowers, directly affecting Student Loan Debt Mortgage Eligibility.

- Improved Mortgage Terms: A better Debt-to-Income Ratio for Mortgages translates to more favorable mortgage conditions.

- Predictable Repayment Structure: Aids in comprehensive Financial Planning for Homeownership.

Cons:

- Complexity and Eligibility Criteria: Understanding the plan’s specifics can be challenging.

- Extended Loan Term: Lower payments might mean a longer repayment period.

Frequently Asked Questions

Q: What advice is there for borrowers considering the SAVE Plan and home purchase simultaneously?

A: Consult a financial advisor to understand how the SAVE Plan can aid planning and balance both student loan management and the home-buying process.

Q: How does the SAVE Plan Student Loans affect mortgage applications for first-time buyers?

A: The plan can substantially improve Student Loan Debt Mortgage Eligibility by enhancing the debt-to-income ratio, making approval more likely.

Q: What impact does the Biden-Harris Administration Student Loan Plan have on long-term financial planning?

A: It provides a more manageable framework for repaying student loans, facilitating better financial planning for future homeowners.

Q: Can the SAVE plan help in improving the Debt-to-Income Ratio for Mortgages?

A: Yes, by reducing or eliminating monthly student loan payments, it significantly betters the ratio which lenders examine.

Q: What are the long-term benefits of the SAVE Plan for future homeowners?

A: The SAVE Plan greatly aids financial planning for homeownership, offering a predictable repayment schedule and potentially freeing up income for future home investments.

Q: How does the Biden-Harris Administration Student Loan Plan impact public service employees?

A: Public service employees could see substantial reductions in their student loan payments, enhancing their mortgage eligibility and ease of homeownership.

Q: Can the SAVE Plan improve my chances of getting a mortgage as a recent graduate?

A: Yes, by reducing your monthly payments it positively impacts your debt-to-income ratio, making you a stronger candidate for lenders.

Q: What role does the SAVE Plan play in the journey towards financial independence for young adults?

A: It eases monthly financial strain and assists long-term wealth building – both crucial for young adults working towards financial security.

Q: What advice is there for borrowers considering the SAVE Plan and home purchase simultaneously?

A: Consult a financial advisor to understand how the SAVE Plan can aid planning and balance both student loan management and the home-buying process.

Conclusion

The SAVE Plan Student Loans initiative is a significant stride by the Biden-Harris Administration towards mitigating the challenges of student loan debt, particularly for those aspiring to homeownership. By understanding and leveraging the benefits of this plan, borrowers can transform their financial future, paving the way to a secure and prosperous life.

Leave a Reply